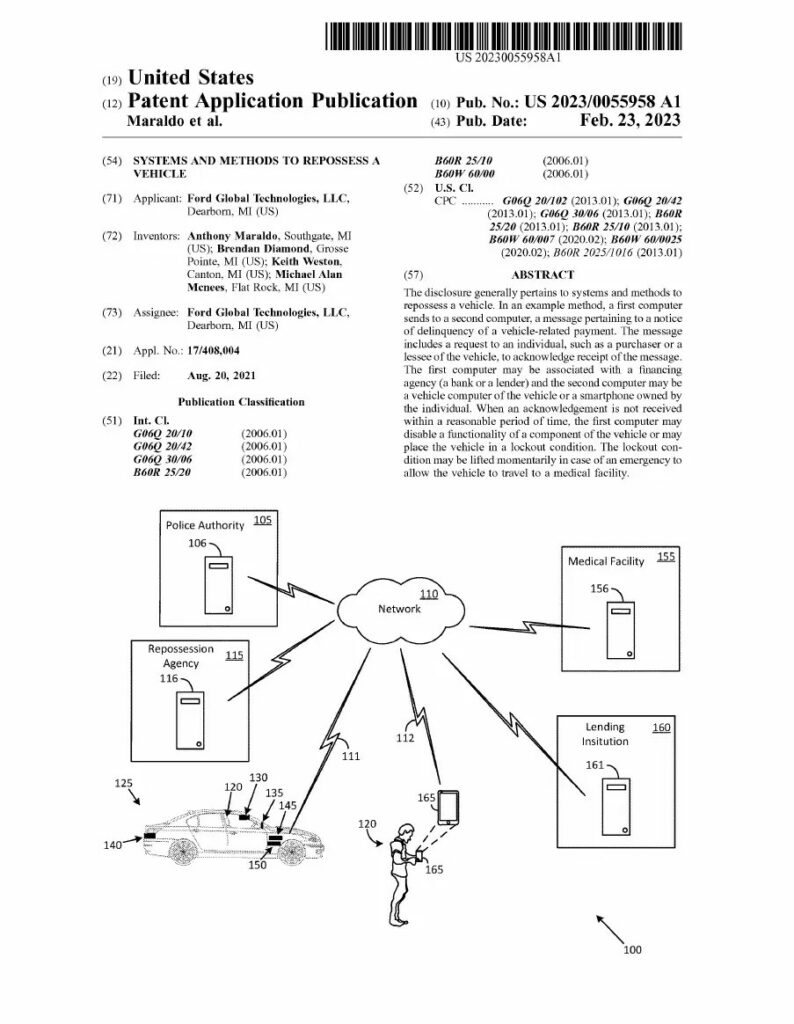

Car repossession has always been a contentious issue. While it’s understandable that lenders want to protect their investments and ensure that borrowers make payments on time, repossession can have serious consequences for individuals who depend on their vehicles for work, school, medical care, and other necessary activities. The rise of autonomous vehicles brings new complexities to the issue of repossession, as evidenced by Ford’s recent patent application for a self-repossessing car.

The Implications of Self-repossessing Cars

While Ford has stated that it has no plans to implement the technology outlined in its patent application, the concept raises important questions about the intersection of autonomous vehicle technology and individual rights. The patent application suggests that a lender could initiate repossession by sending a message through the car’s computer to a screen or the owner’s phone. If the owner fails to respond, the car’s computer could begin disabling parts of the vehicle to induce payments, such as the air conditioner, radio, or key fob. The car could also be restricted to a certain geographic area, with the owner only able to drive to a hospital or meet with an ambulance in case of emergencies.

The idea of an autonomous vehicle repossessing itself is new, but lenders have been using “kill switches” on cars for years to lock out owners who fall behind on payments. While kill switches have also been used to prevent drunken driving and combat vehicle theft, they bring a “fundamentally different burden that used to exist — and an additional humiliation,” according to Dan Schneider, the lawyer for the Chicago car owners who filed a lawsuit after their cars were rendered useless due to activated kill switches.

Concerns for Privacy, Safety of Self-repossessing Cars

One of the key concerns surrounding the use of autonomous vehicles for repossession is the potential for increased surveillance and control. As autonomous vehicle technology becomes more widespread and integrated into our infrastructure, powerful entities could use it to exert more control over individuals. Law enforcement agencies, for example, may see autonomous vehicle technology as a major boon, as it could allow them to put a permanent end to high-speed car chases and potentially seize control of a vehicle as a result of an arrest warrant. While these developments may be seen as positive in some contexts, they also raise important questions about individual rights and privacy.

As an inventor and intellectual property consultant, I find Ford’s recent patent application for a self-repossessing car to be an exciting development in the field of autonomous vehicle technology. While the patent application raises important questions about the potential for increased surveillance and control, it also presents a wealth of opportunities for companies interested in licensing the technology for their own use.

Invent on Top of Ford’s Patent

One potential avenue for building on top of Ford’s patent is the development of new software and services that enable lenders to initiate repossession more efficiently and effectively. For example, a company could create a platform that integrates with Ford’s autonomous vehicle technology to automate the repossession process, allowing lenders to send messages and disable parts of the vehicle with just a few clicks. This could help lenders streamline their operations and reduce the risk of confrontation during repossessions.

Another potential area of innovation is the development of new technologies that enhance the security and safety of autonomous vehicles. For example, a company could build on Ford’s patent to create a system that allows an owner to remotely disable their vehicle in case of theft or unauthorized use. This could help prevent car theft and increase the peace of mind of vehicle owners.

The rise of autonomous vehicle technology also presents new opportunities for companies interested in leveraging the vast amounts of data generated by these vehicles. By building on Ford’s patent, a company could create a platform that enables lenders to analyze data from autonomous vehicles to identify trends and make more informed decisions about lending and repossession.

Licensing Potential for Ford’s Patent

In terms of the types of companies that would be interested in licensing Ford’s patent, I see a range of possibilities. Lenders and financial institutions would likely be the primary customers for this technology, as it would enable them to more effectively manage their loan portfolios and reduce the risk of default. However, there may also be opportunities for technology companies and startups to build on Ford’s patent and create new services and products that enable more efficient and secure repossession of vehicles.

In conclusion, while Ford’s patent application for a self-repossessing car raises important questions about the potential for increased surveillance and control, it also presents a wealth of opportunities for innovation and commercialization. As an inventor and intellectual property consultant, I am excited to see how this technology will evolve and be applied in the years to come.